Growth in high-profile cyber-attacks is driving the oil and gas security and service market.

The oil and gas security and service market size is estimated to grow from USD 26.34 Billion in 2015 to USD 33.90 Billion by 2020, at an estimated Compound Annual Growth Rate (CAGR) of 5.2% from 2015 to 2020. Oil and gas security is defined as the security process in which the oil and gas operational sectors, namely, upstream, midstream, and downstream are secured with the help of stringent physical and network security measures to ensure operational efficiency and minimize losses associated with security breaches. The major forces driving this market are the increased government pressure and security compliance and regulations, threats from terrorist attacks and cyber-attacks, and lack in comprehensive solution for oil and gas security and physical attacks and insider threats.

High-profile cyber-attacks will drive the growth in the oil and gas security market. Surging cyber-attacks targeting oil and gas enterprises are driving the investments in oil and gas security solutions.

Most of the physical assets at oil and gas installations are subject to terrorist attacks, sophisticated and high-profile cyber-attacks. Various surveillance and monitoring techniques such as video surveillance, mass notification, and perimeter security can be instrumental in preventing security breaches as well as conducting effective audit trail. Workforce nowadays are increasingly using mobile devices while working on offshore rigs in remote areas. This has led to investments in network security by enterprises to keep their network infrastructure and communication lines robust and secure.

The major drivers for the oil and gas security and service market are increased spending by oil and gas companies on infrastructure and network protection, growth of Bring Your Own Device (BYOD) in the oil and gas sector, growth in high-profile cyber-attacks, growing political turmoil in the Middle Eastern countries, increase in regulatory compliances, and increased traction for vulnerability assessment and management.

Latin America is expected to witness the largest traction in the oil and gas security market.

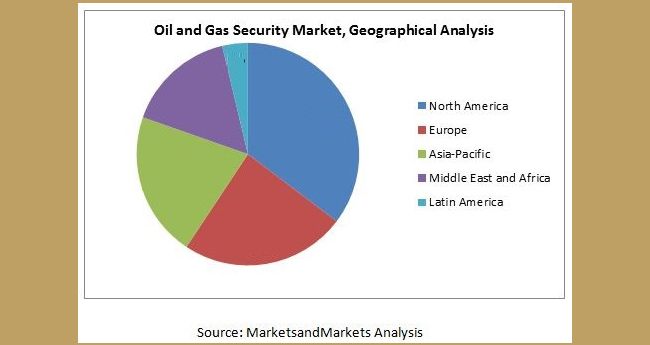

North America is expected to have the largest market share; however, Latin America will grow with the highest CAGR from 2015 to 2020. North America has been at the forefront in adopting oil and gas security solutions. Furthermore, this region has been extremely responsive toward adopting the latest technological advancements such as integration with cloud and mobile technologies within oil and gas security solutions to yield proper secured access mechanism and enforcing a security governance framework within a secured installation.

The major vendors in the oil and gas security and services market include ABB, Intel Security, Symantec Corporation, Cisco Systems, Inc., Honeywell International, Inc., Lockheed Martin Corporation, Microsoft Corporation, Siemens AG, UTC, and others. A detailed analysis of the key industry players has been done to provide insights into their business overview, products and services, key strategies, and recent developments associated with the oil and gas security and services market.

MarketsandMarkets has segmented the global oil and gas security and services market by type of application, by security type, by service, and by region. The exploration and drilling application security continues to be the largest segment, in terms of spending and adoption, for oil and gas security solutions. This is followed by refineries and storage security. The report also covers the total oil and gas security and services market by geographic regions.